The Ministry of Finance introduced Notification No. 22/2024-Central Tax on October 8, 2024, providing a streamlined procedure for rectification of orders related to input tax credit (ITC) under the Goods and Services Tax (GST) framework. This notification benefits taxpayers who had earlier contravened subsection (4) of Section 16 of the GST Act but now qualify for ITC as per subsections (5) or (6).

In this article, I’ll cover the key provisions of this notification and provide a step-by-step guide for filing the rectification application.

Key Highlights of Notification No. 22/2024

- Scope of Application:

- Rectification applies to orders issued under Sections 73, 74, 107, or 108 of the GST Act.

- Covers cases of incorrect ITC availment due to non-compliance with Section 16(4), but now eligible under Section 16(5) or 16(6).

- Applicable only if no appeal has been filed against the original order.

2.Time Limit:

- Applications must be filed within six months from the issuance date of the notification (by April 7, 2025).

3. Process Overview:

- Applications must be filed electronically via the GST portal.

- Supporting details in Annexure A must accompany the application.

4. Role of Authorities:

- The issuing authority will decide on the application and issue a rectified order, typically within three months.

5. Outcome:

- Rectification orders will be uploaded electronically in either:

- FORM GST DRC-08 (for orders under Sections 73 or 74).

- FORM GST APL-04 (for orders under Sections 107 or 108).

6. Principles of Natural Justice:

- If the rectification adversely impacts the taxpayer, due process will be followed.

Relevant Provisions of Section 16 of the GST Act

Section 16 of the GST Act outlines the eligibility and conditions for availing input tax credit (ITC).

Below are key excerpts relevant to Notification No. 22/2024:

Section 16(4):

“A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the thirtieth day of November following the end of the financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.”

Section 16(5):

“Notwithstanding anything contained in subsection (4), in respect of an invoice or debit note for supply of goods or services or both pertaining to the Financial Years 2017-18, 2018-19, 2019-20, and 2020-21, the registered person shall be entitled to take input tax credit in any return under Section 39 which is filed up to the thirtieth day of November, 2021.”

Section 16(6):

“Where registration of a registered person is cancelled under Section 29 and subsequently the cancellation of registration is revoked… the said person shall be entitled to take the input tax credit in respect of such invoice or debit note for supply of goods or services or both, in a return under Section 39 filed within the applicable timelines.”

Step-by-Step Process for Filing the Rectification Application

Follow these steps to submit the rectification application as per Notification No. 22/2024:

Step 1: Access the GST Portal

- Visit GST Portal.

- Log in using your valid credentials.

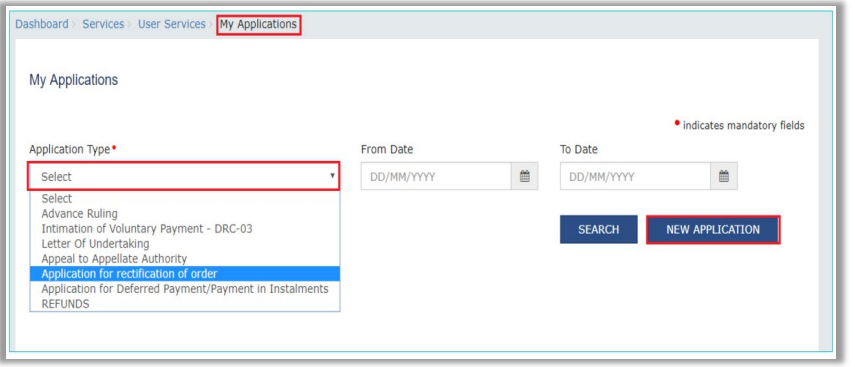

Step 2: Navigate to the Application

- Go to Dashboard > Services > User Services > My Applications.

Step 3: Select the Application Type

- In the Application Type field, choose Application for Rectification of Order.

- Click the NEW APPLICATION button.

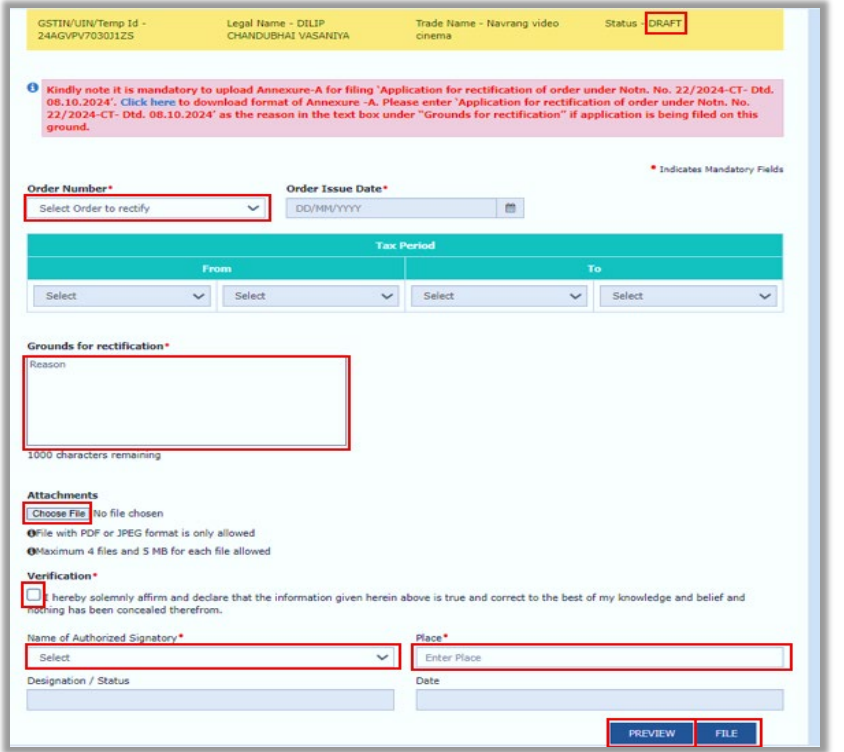

Step 4: Enter Order Details

- Select the relevant Order Number from the dropdown menu.

- The fields for Order Issue Date and Tax Period will auto-populate.

Step 5: Specify the Grounds for Rectification

- Provide the reason: “Application for rectification of order under Notification No. 22/2024-Central Tax dated 08.10.2024.”

Step 6: Upload Annexure A

- Prepare the required details in Annexure A as per the format outlined in the notification.

- Upload the document using the Choose File option. This step is mandatory.

Step 7: Complete the Verification

- Enter the verification details:

- Select the declaration checkbox.

- Choose the name of the authorized signatory.

- The fields for Designation/Status and Date will auto-populate.

- Provide the name of the place where the application is being filed.

Step 8: Preview and File the Application

- Click on PREVIEW to review the details.

- Submit the application by clicking FILE.

Important Considerations

- Ensure all details in Annexure A are accurate and complete. Any errors could lead to rejection or legal complications.

- Verify that no appeal is pending against the order in question.

- Maintain copies of the application and supporting documents for your records.

Conclusion

Notification No. 22/2024 provides a valuable opportunity for taxpayers to rectify past ITC-related discrepancies without undergoing lengthy appellate processes. By adhering to the prescribed procedure and timelines, businesses can ensure compliance and avoid additional liabilities.

For more guidance or assistance, feel free to contact Your Commercial Attorney—your trusted partner for taxation, ROC filings, and more.

Add comment